Indexation of the general transfer balance cap (TBC) is due to occur on 1 July 2023. The cap will increase by $200,000.

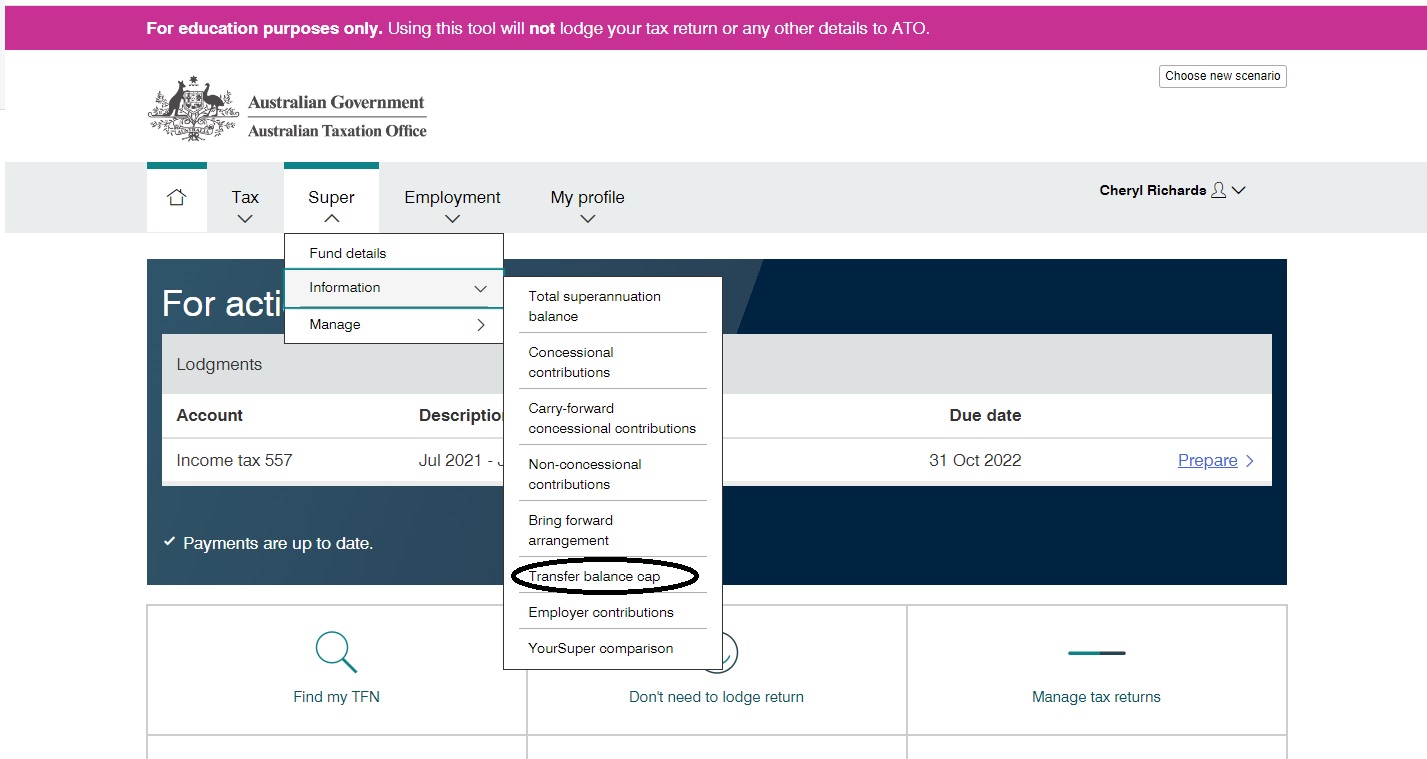

No single TBC will apply to all individuals. Individuals will have a personal TBC between $1.6 and $1.9 million. If an individual already has a TBC, the only place they can view their personal TBC is in ATO online services through myGov.

We will calculate each individual’s personal TBC based on the information reported to and processed by us. If you report pre – 1 July 2023 events after that date, there may be significant consequences for the individual. We’ll reconsider if there was an entitlement to proportional indexation and apply this new information to their account.

To help members have a clear understanding of their position, we encourage you to report all events which occurred in the 2022–23 income year or earlier as soon as possible.

Indexation of the general TBC will also lead to changes in a number of other caps and limits in the super system including the defined benefit cap that will increase to $118,750.00.

Don’t forget for more information for SMSFs – You can keep up to date with our recently published SMSF news and alerts or you can subscribe to SMSF newsExternal Link for a monthly wrap-up of news and updates.